When customizing a pet insurance coverage coverage, it is essential to know which variables have the most important impression in your premium and which variables have the most important impression in your out-of-pocket bills (premium included).

Pet insurance coverage corporations help you customise your coverage primarily by permitting you to decide on amongst a number of annual maximums, deductibles or reimbursement percentages.

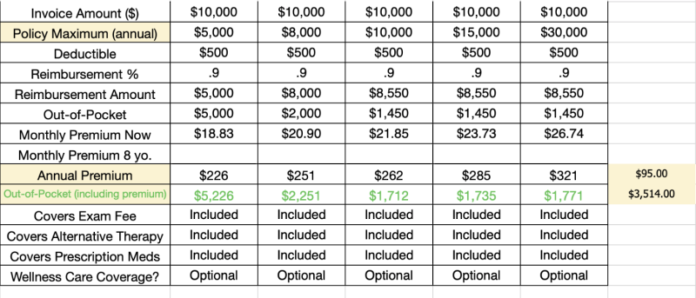

Some corporations help you customise solely one in all these variables and a few corporations permit you customise all 3 of those variables. I’m utilizing Embrace pet insurance coverage firm for instance this. Embrace lets you customise all 3 variables.

I’m additionally utilizing a declare quantity of $10,000 to calculate the out-of-pocket expense. The rationale I am utilizing $10,000 is as a result of 98% of pets have < $10,000 of claims filed yearly. The opposite 2% contains claims as much as $50,000 plus.

Earlier than you begin getting quotes, ask your self:

“What’s the most quantity I can afford to pay out-of-pocket for a month-to-month premium?”

Additionally ask:

“If I needed to file $10,000 in claims, how a lot can I afford to pay out-of-pocket ($10,000 – deductible and copay)?”

Contemplate how a lot money in addition to funds in your checking and financial savings accounts and any out there credit score. In the event you preserve a funds, then you definitely probably understand how a lot discretionary earnings you might have month-to-month plus financial savings and credit score.

Amazingly, a whole lot of pet house owners don’t even take into consideration this till they’re of their veterinarian’s workplace with a really sick or injured pet and they’re introduced with an estimate for prognosis and remedy of a number of thousand {dollars}. That’s not the very best time to begin excited about how you’d pay for a probably massive vet invoice.

Whether or not you might have pet insurance coverage or not, you have to take into consideration this and have a plan BEFORE one thing main and sudden occurs. I can let you know after a few years in follow, it will occur in the end and it is best when you’re ready.

Tip #1: Get the best coverage most you possibly can afford

You purchase insurance coverage to cowl these bills you possibly can’t afford to pay out-of-pocket. Amazingly, it additionally has the least impression in your premium.

As you possibly can see, there’s solely a $95 distinction within the premium between the bottom ($5,000) and highest ($30,000) annual most. So, you will get 6 instances the protection for less than $95 extra yearly!

Nonetheless, the distinction within the out-of-pocket expense between the bottom and highest annual most is $3514. When you might have a $5,000 annual most and $10,000 in claims, the deductible and copay do not even come into play. You pay the distinction ($5,000 + the annual premium) for the yr. Similar situation applies for the $8,000 annual most.

Tip #2: Get the best reimbursement (lowest copay) you possibly can afford.

Even after you’ve met your deductible, you’ll nonetheless pay the copay on each declare you submit. Since it is a share, the upper the declare quantity, the extra you’ll pay out-of-pocket.

The distinction within the premium between the best (90%) and lowest (70%) reimbursement is $125.

Nonetheless, the distinction within the out-of-pocket expense between the best and lowest reimbursement is $1845.

Tip #3: Regulate the deductible to get a premium you possibly can afford

It would have the best impression on the premium and least impression in your out-of-pocket expense.

Utility:

When getting a pet insurance coverage quote, choose the best coverage most, highest reimbursement after which alter the deductible to get a premium that you would be able to afford to pay each month. Provided that wanted, decrease the reimbursement share subsequent. Lastly, and provided that completely essential, decrease the coverage most.

There are different methods some corporations help you customise your coverage. They could make protection for examination charges, different remedy, prescription medicine and wellness care elective. In the event you decide to have all or any of these lined, it would add just a few {dollars} to your premium every month.

When getting a quote and evaluating pet insurance coverage corporations, you need to get as near an apples to apples comparability as doable. That is why I counsel to incorporate all elective coverages (besides wellness) as a result of some corporations mechanically embody these coverages of their coverage (Embrace is one in all them) and also you need to have the ability to evaluate corporations as precisely as doable. Nonetheless, as a result of some corporations do not provide wellness care protection in any respect, do not embody it in your quote.

You need to evaluate corporations primarily based totally on their accident/sickness protection as a result of that is the principle cause you buy pet insurance coverage (sudden/costly occasions). After selecting the corporate with the very best accident/sickness protection that matches your wants and funds, if you wish to embody wellness care protection, hopefully the one you’ve got chosen will provide it as an elective protection additionally.

Watch this quick video the place I show how to do that utilizing a quote from Pets Greatest:

Bonus Tip:

There may be one other software for this technique. Your premiums will improve over time attributable to your pet getting older, veterinary inflation (greater wages/advantages for veterinary workers, rising prices of provides and medicines, new tools, and many others.), and actuarial changes every time the pet insurance coverage firm re-files their charges with the state Dept. of Insurance coverage.

When premiums rise outdoors of what you possibly can afford, the temptation is to drop the insurance coverage. Nonetheless, it’s best to first contemplate downgrading your protection – drop any elective protection that you do not want anymore, elevate the deductible, decrease the reimbursement share, or decrease the coverage most (in that order). When you could not must take all of those actions, shopping for a coverage from an organization that enables extra flexibility when customizing your coverage (skill to regulate all 3 – coverage most, reimbursement and deductible) places you in a greater place to regulate your stage of protection to reach at an inexpensive premium when the inevitable rise in premiums happen.

Associated articles:

Tips To Customized Design Your Pet Insurance coverage Coverage