Stopping pricey accidents and sicknesses is definitely one of the simplest ways to save cash in your pet’s healthcare. The very best sources I’ve ever seen to make pet homeowners conscious of what could be prevented (most are issues you are able to do at dwelling for little or no prices), are the “101 Important Ideas” books by Dr. Jason Nicholas. Embrace the coupon code GUIDE101 to get 15% off if you buy the books. You can too take heed to this interview I did with Dr. Nicholas concerning the newly up to date books and why each pet guardian ought to have this useful resource of their dwelling.

Most individuals will pay for wellness care and acute minor accidents/sicknesses out of their common finances/discretionary funds. Nevertheless, sudden/costly occasions that require hospitalization/surgical procedure and persistent situations are the 2 classes of pet healthcare bills that often require funds not in a family’s month-to-month money circulation. Subsequently, you want to plan forward for these.

A balanced plan that can will let you pay for nearly any pet healthcare expense contains budgeted financial savings, pet insurance coverage, and a line of credit score.

- Have a devoted financial savings/debit account or class in your finances only for pet healthcare bills. This isn’t for pet food, treats, toys, and so forth. Deposit cash into it each pay interval with out fail. You need to use this to pay vet payments, pet insurance coverage premiums, deductible copay, and so forth.

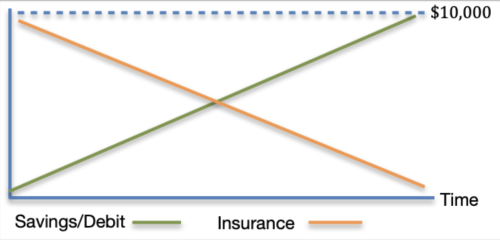

- Pet insurance coverage coverage – that is to assist bridge the hole between what your pet wants and what you may afford till you get your financial savings/debit stability funded.

- Credit score line – ideally, the objective is to not carry a stability, however to repay month-to-month out of your financial savings/debit class or utilizing a pet insurance coverage reimbursement.

My spouse and I exploit a digital, category-based budgeting system “You Want A Price range” (YNAB). That is equal to an envelope budgeting system. With each paycheck, our earnings is distributed into all of the totally different classes that we spend from each month. All spending transactions are by class and the system retains monitor of a working stability in every class. If we use a bank card to pay a invoice, the cash is subtracted from the class stability and added to the bank card class in order that the cash is at all times there to repay the bank card invoice each month.

Watch this video as Hannah explains 3 budgeting strategies you should use with YNAB. Utilizing her personal finances for example, she contains useful tips about budgeting for pet bills.

One other attention-grabbing choice that can assist you save/finances for pet healthcare is Ally.

The perfect state of affairs is to be self-insured – you’re capable of pay any dimension veterinary invoice out-of-pocket. Once I use the time period “out-of-pocket,” I’m referring to prepared money, not money plus credit score (debt that must be paid again).

Statistics say that claims filed for 98% of insured pets might be lower than $10,000 in a coverage yr. The opposite 2% are outliers – some paid claims have been for $50,000 or extra. Utilizing $10,000 because the objective for a fully-funded pet healthcare account/class, have a look at the determine under: